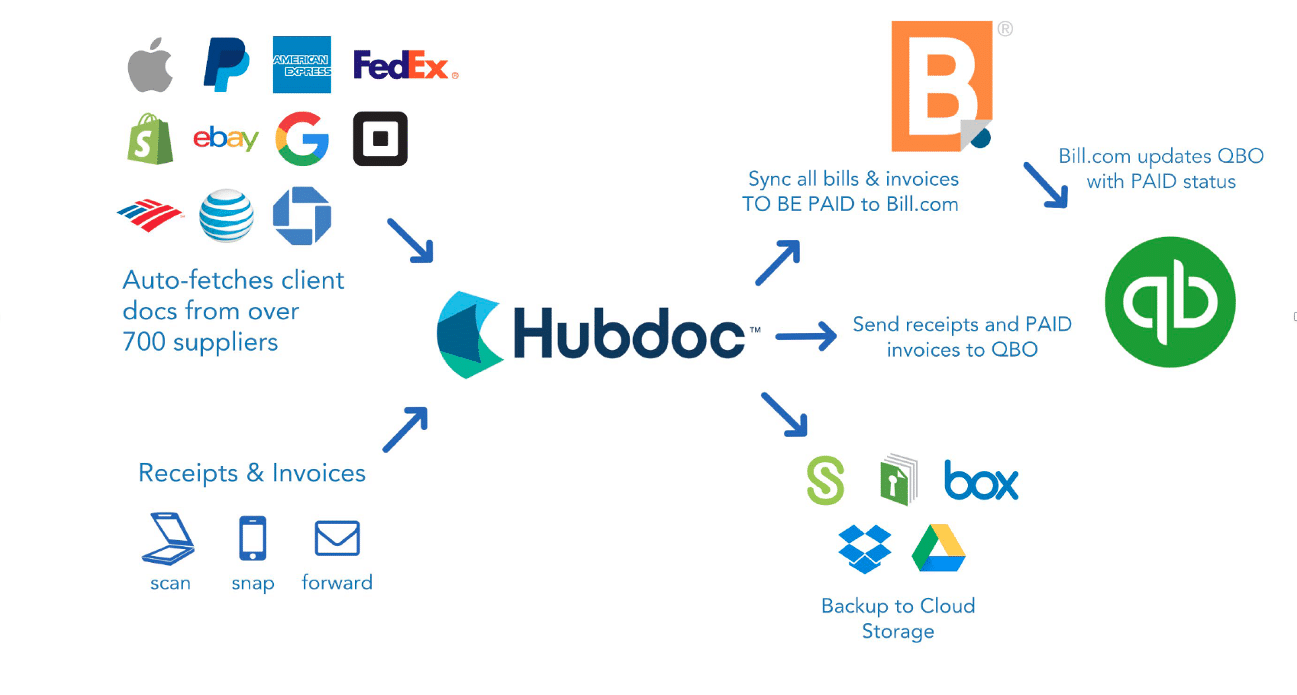

Core Business Applications my clients use for Accounts Payable: QBO, Hubdoc and Bill.com

Cloud accounting and it’s ecosystem is essential for any business. Invoicing customers, receiving payments, paying bills and keeping your data organized. For the “accounts payable department” of the business, Quickbooks Online with Hubdoc and Bill.com helps you perform this function with high efficiency.

Automated Payment Processing with Hubdoc and Bill.com:

Hubdoc can help fetch statements from bank, utilities, and other companies. You can upload bills, receipts and invoices. Hubdoc extracts key data such as: vendor name, date, total amount and invoice number. You record the expense account which can be memorized and set for future bills. The data is then posted to Bill.com.

Once in Bill.com, the bill is put through an automated approval workflow that is customizable. You can set up daily notifications for what needs to be approved and paid. With ease and convenience, the approver can approve and submit for payment all through the use of a mobile app.

This standardized process helps save time and minimizes data entry. Using the company’s credit card and generating a lot of receipts? No problem. Here is an example of how this process works for all of your receipts:

Client uses a company credit card and makes lots of purchases. The receipt is scanned and uploaded to Hubdoc. Review and record the expense account. These receipts are pushed to Quickbooks Online and recorded in the credit card register. When the credit card statement comes, you upload to Hubdoc and post it to Bill.com for payment. All of your records are saved as PDF in Hubdoc, transactions recorded, payment made. In addition, the bank feed in Quickbooks online helps reconcile all the activity at the credit card and bank account level.

This set up has made accounts payable work become a breeze. I can help you streamline the process so that you can focus on the business and not piles of invoices.