The Corporate Transparency Act (CTA) requires many companies to report information about their owners to the Financial Crimes Enforcement Network (FinCEN), known as the Beneficial Ownership Information (BOI) Report.

The law, which began on January 1, 2024, has been updated with new FAQs. Keep in mind, most companies need to file before December 31, 2024. But there are some exceptions noted below.

BOI Reporting Guidance

Here’s a summary of what you need to know.

Who Needs to Report?

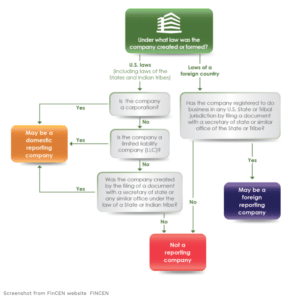

If your company is a corporation, LLC, or a similar entity formed by filing with a U.S. state or a foreign company registered to do business in the U.S., it’s likely you need to report. Some entities like statutory trusts or business trusts also fall under this requirement.

To help, FinCEN created this chart:

Who’s Exempt?

Certain entities, like publicly traded companies, nonprofits, and some large businesses, don’t need to report. There are 23 types of exemptions, and you can check FinCEN’s Small Entity Compliance Guide (updated as of December 2023) for more details.

Who is a Beneficial Owner?

A beneficial owner is anyone who has substantial control over the company or owns at least 25% of it. This could include senior officers, key decision-makers, or anyone who can appoint or remove directors. Here are four ways someone can exercise substantial control over a reporting company.

- The person holds a top leadership position in the company, such as president, CEO, CFO, COO, or general counsel, OR

- The person has the power to hire or fire officers or a majority of the board members in the company, OR

- The person plays a key role in making major decisions about the company’s operations, finances, or overall structure, OR

- The person has any other significant control over the company, as detailed in FinCEN’s Small Entity Compliance Guide.

What Information Must Be Reported?

If the individual applying on behalf of the company is involved in corporate formation, such as an attorney or formation agent, the business address must be reported. If not, the applicant’s home address should be provided instead.

No financial details or information about the company’s purpose or operations need to be provided.

For the company, you’ll need to provide:

- Your company’s legal name,

- Trade names,

- Address,

- Formation jurisdiction, and

- Taxpayer Identification Number.

For each beneficial owner, you must include their:

- Name,

- Date of birth,

- Address, and a

- Unique ID number from a document like a driver’s license or passport.

How to Report?

Reports are filed online on the FinCEN website. Select “File BOIR.” You must file an initial report once. This isn’t an annual report.

When to Report?

If your company was formed or registered before January 1, 2024, you must submit your report by January 1, 2025. Companies formed after January 1, 2024, need to file within 90 days of their registration date. For those created after January 1, 2025, you have 30 days to report.

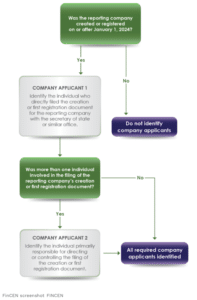

Who is a Company Applicant?

For companies created after January 1, 2024, you need to report who filed the documents to create or register the company. This usually includes one or two people.

- The person who submits the paperwork to establish or register the company; and

- If multiple people are involved, the person who takes the lead in overseeing or managing the filing process.

FinCEN developed a flowchart to assist in identifying the company applicant.

Are Sole Proprietorships Included?

No, unless the sole proprietorship was established through a filing with a state office.

What About S-Corps?

Yes, if an S-Corp qualifies as a reporting company, it must comply with these rules.

Do Older Companies Need to Report?

Yes, even if your company was created before the CTA was enacted, you must still report.

What If My Company Ceased to Exist?

If your company dissolved before January 1, 2024, you don’t need to report. However, if it existed after that date, you must report even if you’re no longer in business.

Do I Need to Update Information?

If any details change after filing, you must update your report within 30 days. This includes changes in ownership or a beneficial owner’s information.

Costs and Penalties

Filing with FinCEN is free, but you may incur fees if you hire a professional to help. Failure to report can result in fines of up to $500 per day and even imprisonment.

Legal Challenges

A federal court recently ruled the CTA unconstitutional, but this ruling only applies to the plaintiffs. The government has appealed the decision, so the law remains in effect for others.

Want More Information?

Visit FinCEN’s website for more details and updates on the Corporate Transparency Act.

Don’t Wait!

Stay ahead of the curve and ensure your company is compliant with the latest reporting requirements. Don’t wait—protect your business from potential penalties and keep your operations running smoothly. Contact us for more details, guidance, and filing requirements.

You Might Also Like

- Trusts and Estates Accounting: Understanding the Basics for Effective Administration

- Navigating the Complexities of Trusts and Estates Accounting: A Comprehensive Guide

- Maximizing Efficiency in Trusts and Estates Accounting: Best Practices and Strategies

- Protecting Legacies: The Importance of Accurate Trusts and Estates Accounting