Virtual Currency (Cyrptocurrency) is considered very secure because they use strong cryptography to verify the transfer of assets. When you buy and sell virtual currency, blockchain is used to record the transaction. Unlike transactions in stocks where you have a few lines listing Sale Amount and Date vs. Purchase Amount Date, blockchain can have a lot of lines of transactions because previous lines helps validate the source.

It is important to keep track of your transactions. At year end, before December 31st, you will need to run a report and download the transactions. Unlike financial institution such as Merrill Lynch, etc. you will not get a year-end report. You will need to create it yourself.

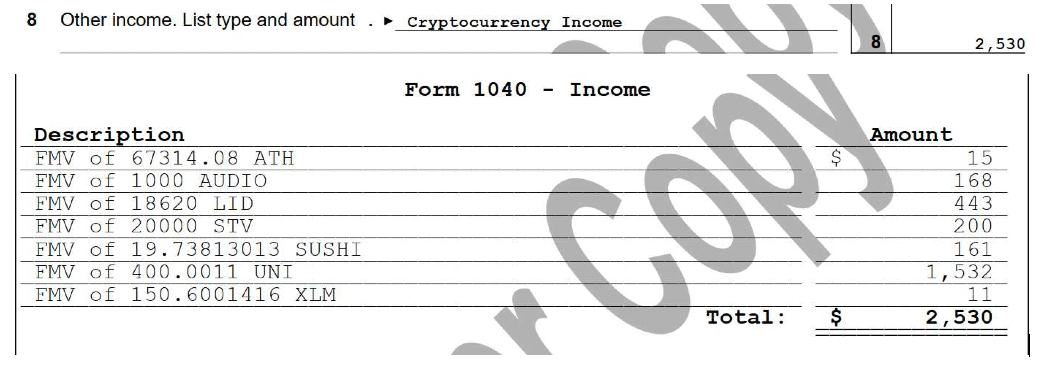

Normally, virtual currency is viewed as property for tax purposes. However, when virtual currency is received for the performance of services, it is treated as ordinary income and subject to any applicable payroll or self-employment taxes that a cash payment would be subject to. Receiving Coins for Goods or Services, you need to record FMV at time of receipt. One set of reporting on the tax return is Schedule 1, Line * – Other Income.

Here is a case study to walk you through a scenario.

Question: What are the tax implications of some recent virtual currency transactions that occurred. You transferred some virtual currency with a $600 FMV and $450 basis from one virtual currency wallet account owned solely by you to another virtual currency wallet account also owned solely by you. You also recently did some consulting work for a company and was paid with virtual currency for those services. The virtual currency received had a FMV of $400 on the date you were paid. At the end of the year, the virtual currency is worth $500.

How much taxable income should you report from your virtual currency transactions during the year, will the income be ordinary or capital, and is any of it subject to self-employment tax?

Answer: You will have $400 of taxable as ordinary income from the performance of consulting services and subject to self-employment tax. The amount taxable to Sue will be the FMV (in U.S. dollars) of the currency on the date it was paid. The value of the currency at the end of the year is irrelevant. The transfer of the virtual currency from one wallet to another account or wallet owned you is a nontaxable event even if you receive a Form 1099 or other informational reporting.

Download Now: TTB Handout TY2021 Virtual_Currency_Cryptocurrency_2021