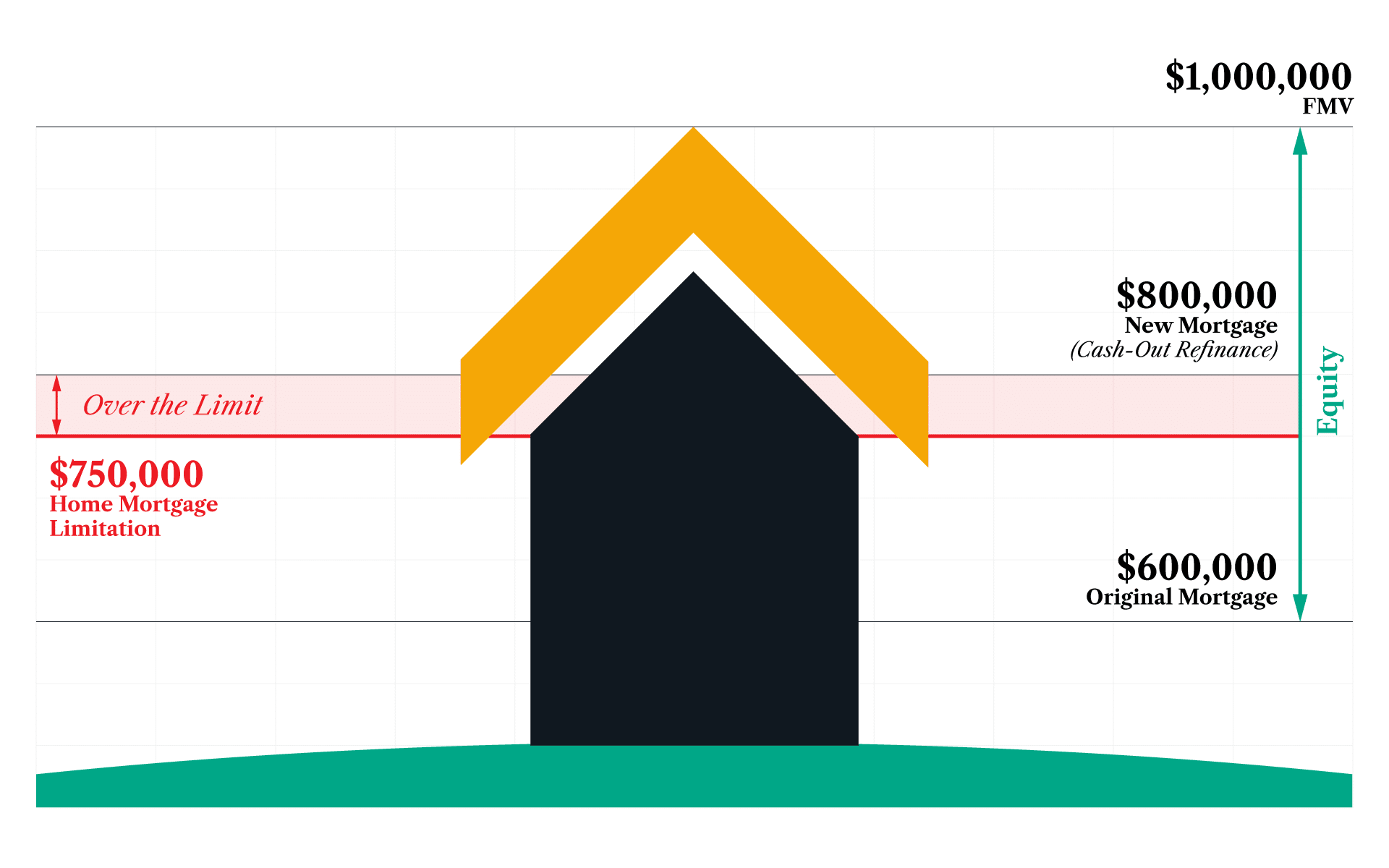

How to use equity in your home and bypass the $750K Mortgage Interest Limitation

Here’s what’s happening:

Under Tax Cut and Jobs Act, for tax years beginning after December 31, 2017 and before January 1, 2026 a taxpayer may not deduct home mortgage interest expense greater than $750,000 mortgage on taxpayer’s principal residence.

Here’s what I think about it:

With real estate appreciating in value, hopefully you are benefitting with built in equity on your primary residence. There are at least a couple of scenarios that I see possible in borrowing against your primary residence in a cash-out refinance. Taking a loan against your home may provide opportunities to pursuing your interest.

Here are some things you can do about it:

- use the money to start a business. This allows you to have funding for start-up cost, etc.

- buy bitcoins.

- purchase an investment property and need a down payment. Make sure you run scenarios to achieve positive cash flow before making the purchase.

Here’s Why:

If the debt is traceable to other expenditures, the interest is treated under the various rules for personal, trade or business, passive activity, or investment interest, depending on the use of the proceeds as determined by the tracing rules. The fact that debt is in excess of the ceiling on qualified residence debt is irrelevant and is deductible.

Disclaimer:

There are different rules applied to home acquisition debt and home equity loans. This blog focuses only on home acquisition debt.